Q4

2025

The Look

Ahead

Late 2025 brought economic stabilization as inflation cooled and spending held up, while construction faced continued cost and labor constraints.

Stabilization Amid Uncertainty

National Market Overview

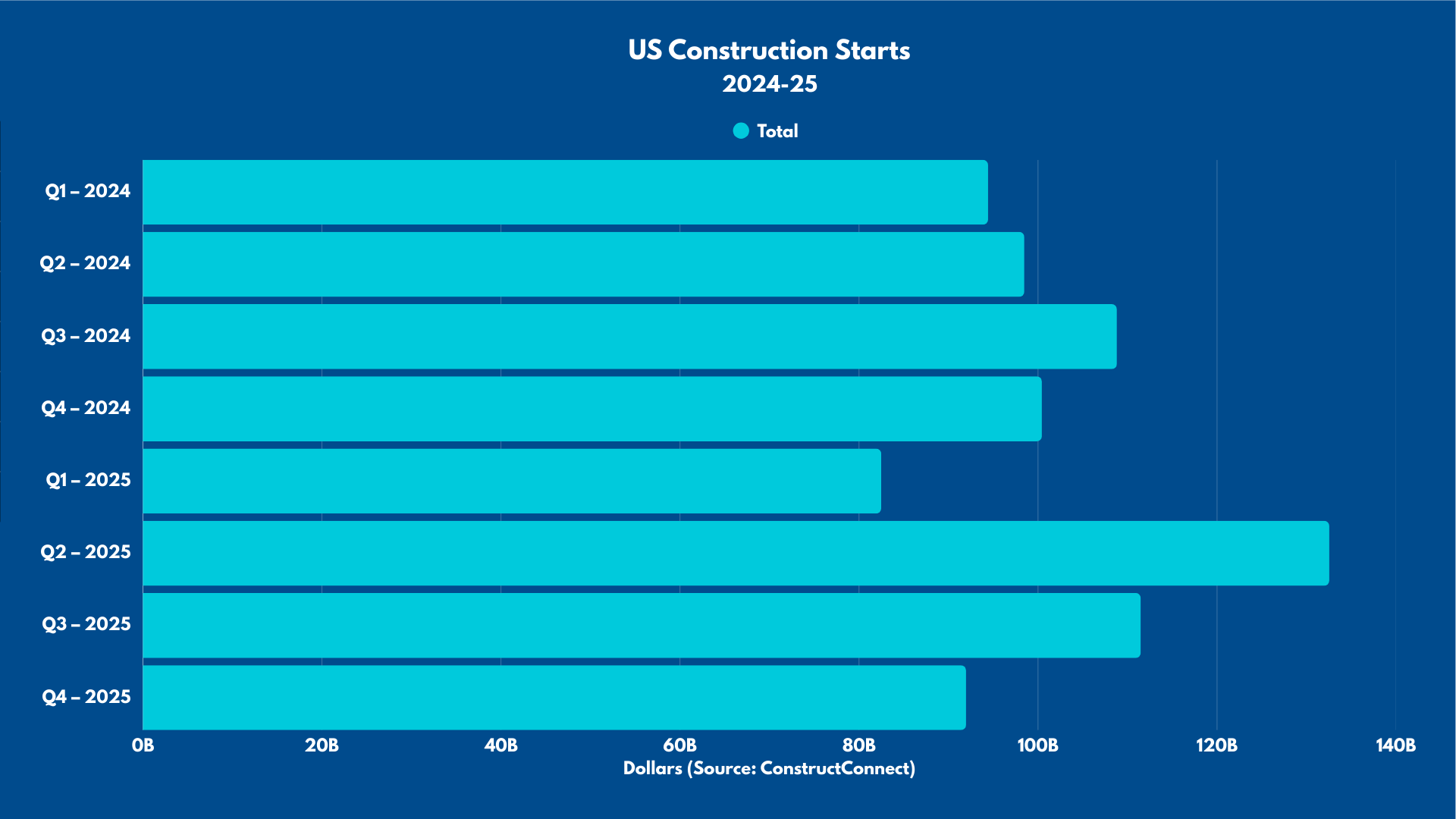

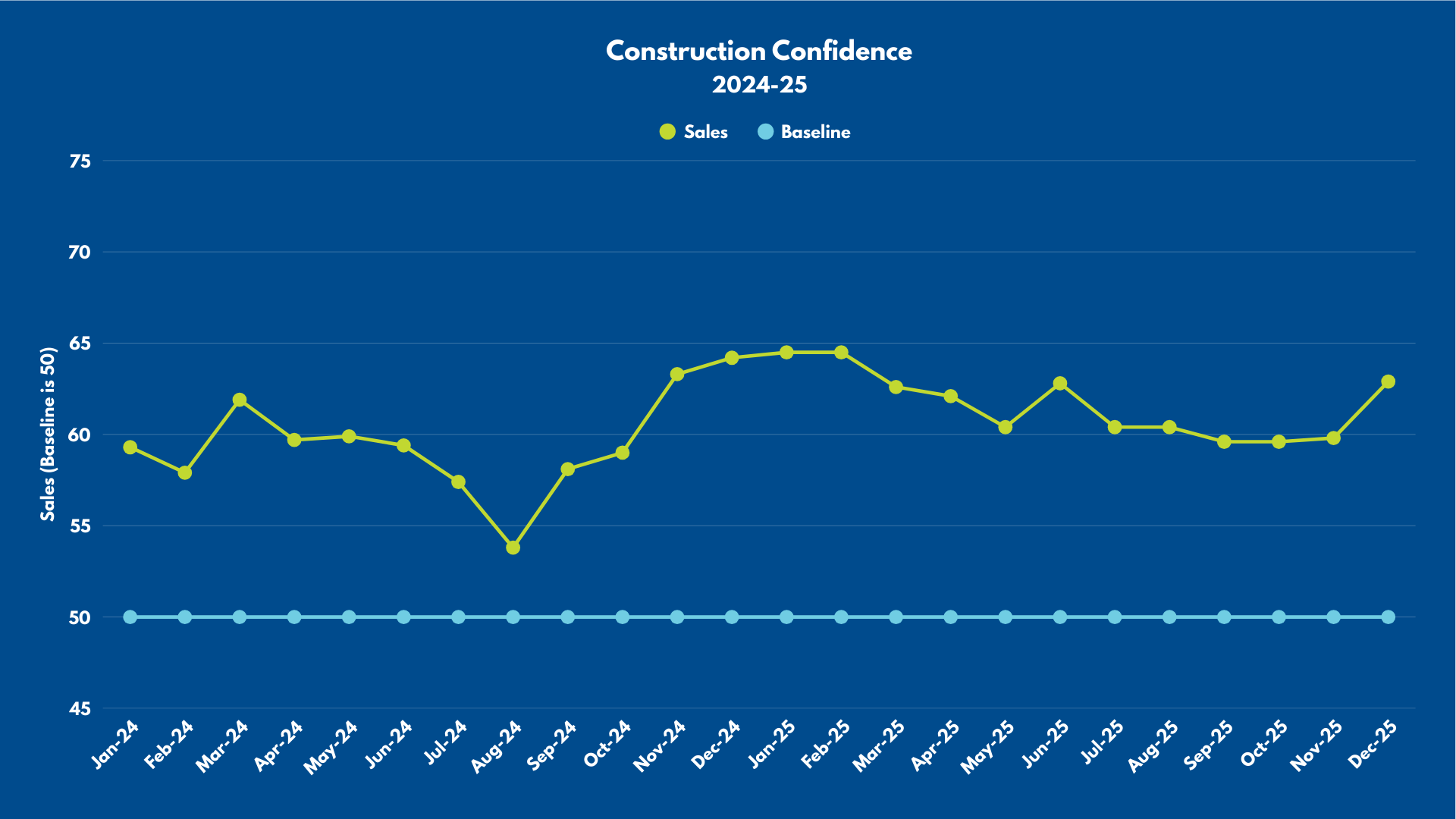

The final quarter of 2025 unfolded in unexpected ways. Labor conditions weakened meaningfully but then leveled off, while inflation edged lower at year-end for the first time in several months. The Federal Reserve implemented two interest rate cuts, equity markets continued to be shaped by outsized gains in AI-related stocks, and disruptions in government data reporting limited visibility into key economic indicators. Despite subdued consumer confidence and modest wage growth, household spending held up, helping drive full-year economic growth to an estimated 2.5%.

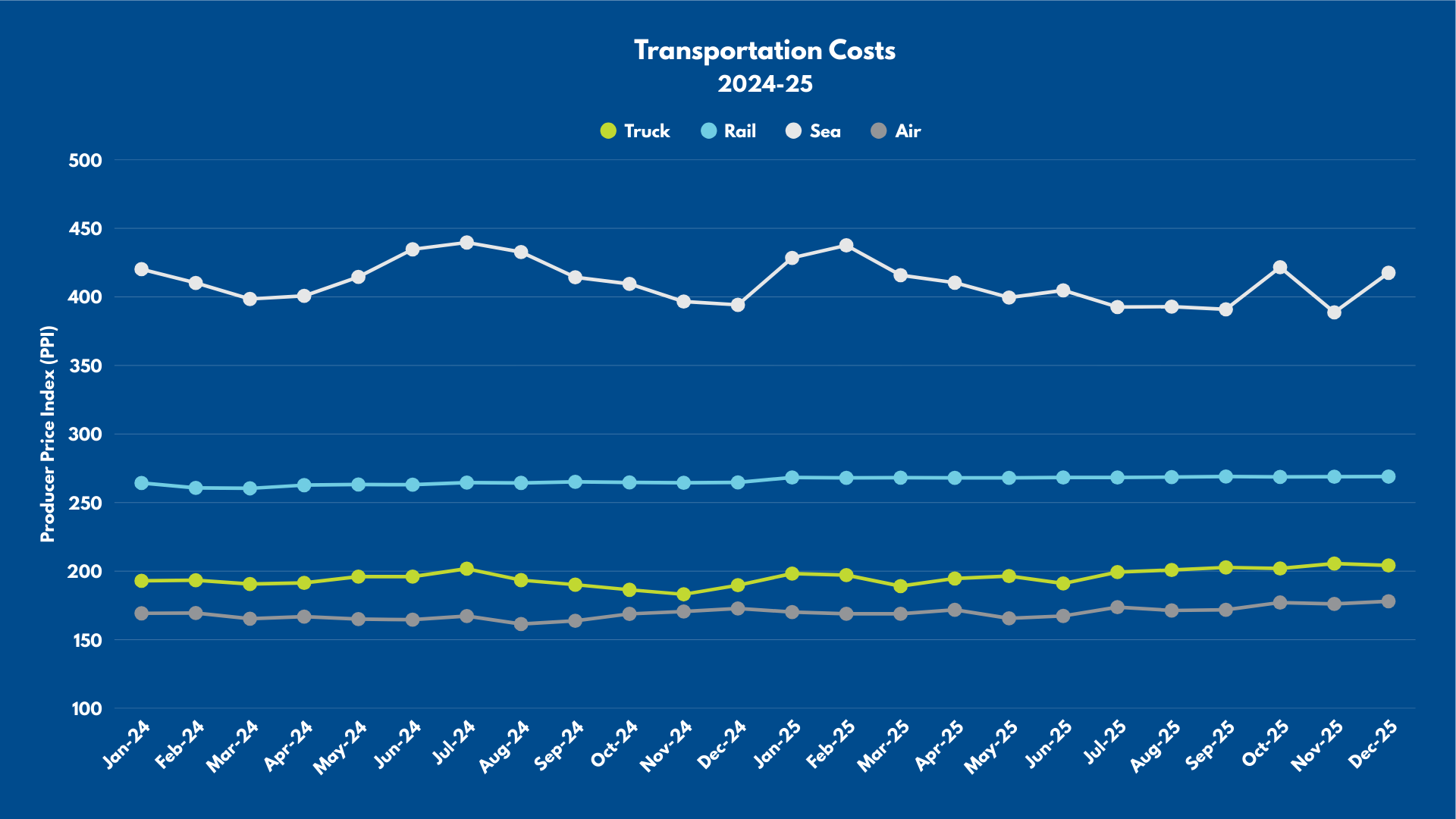

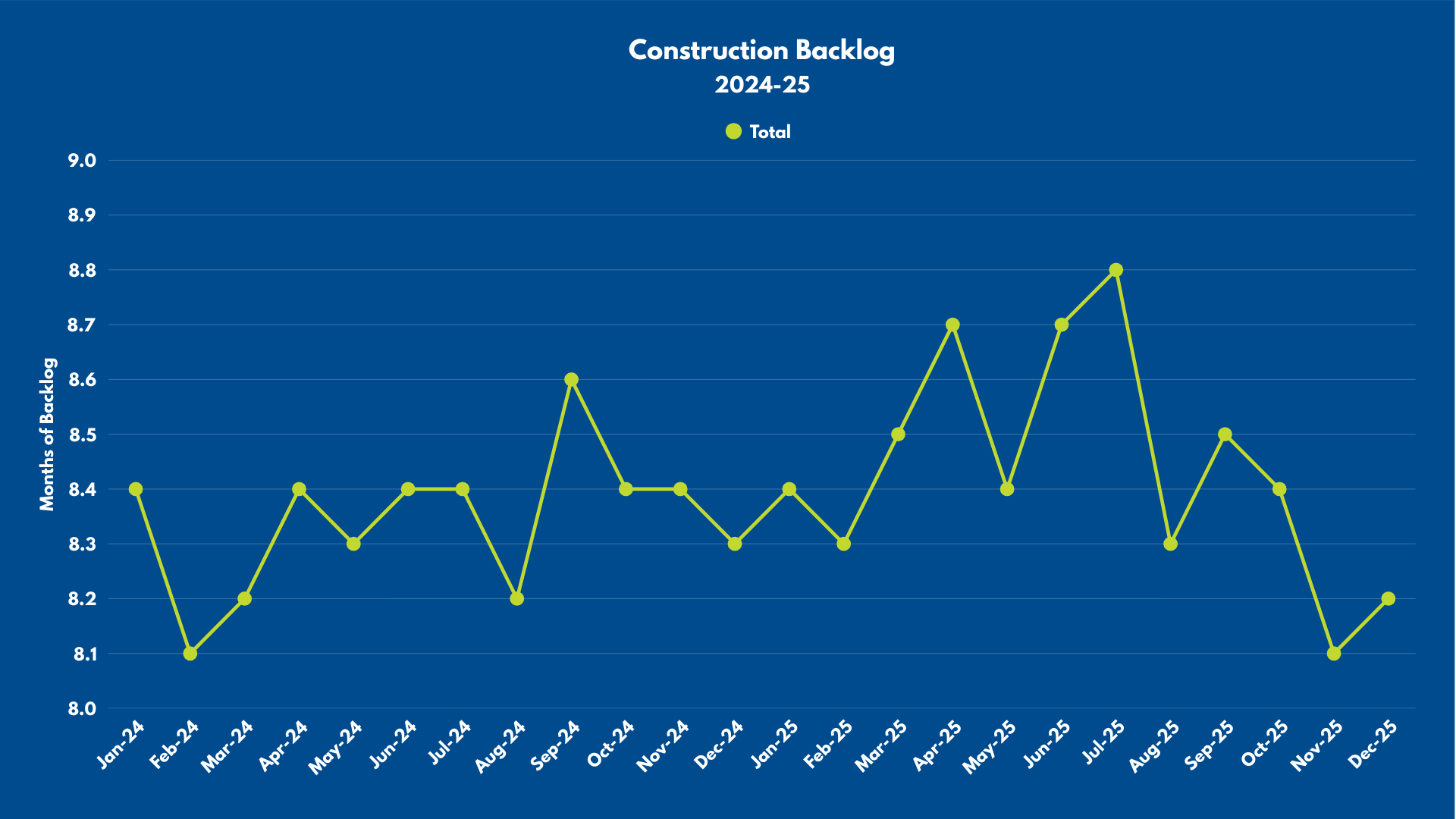

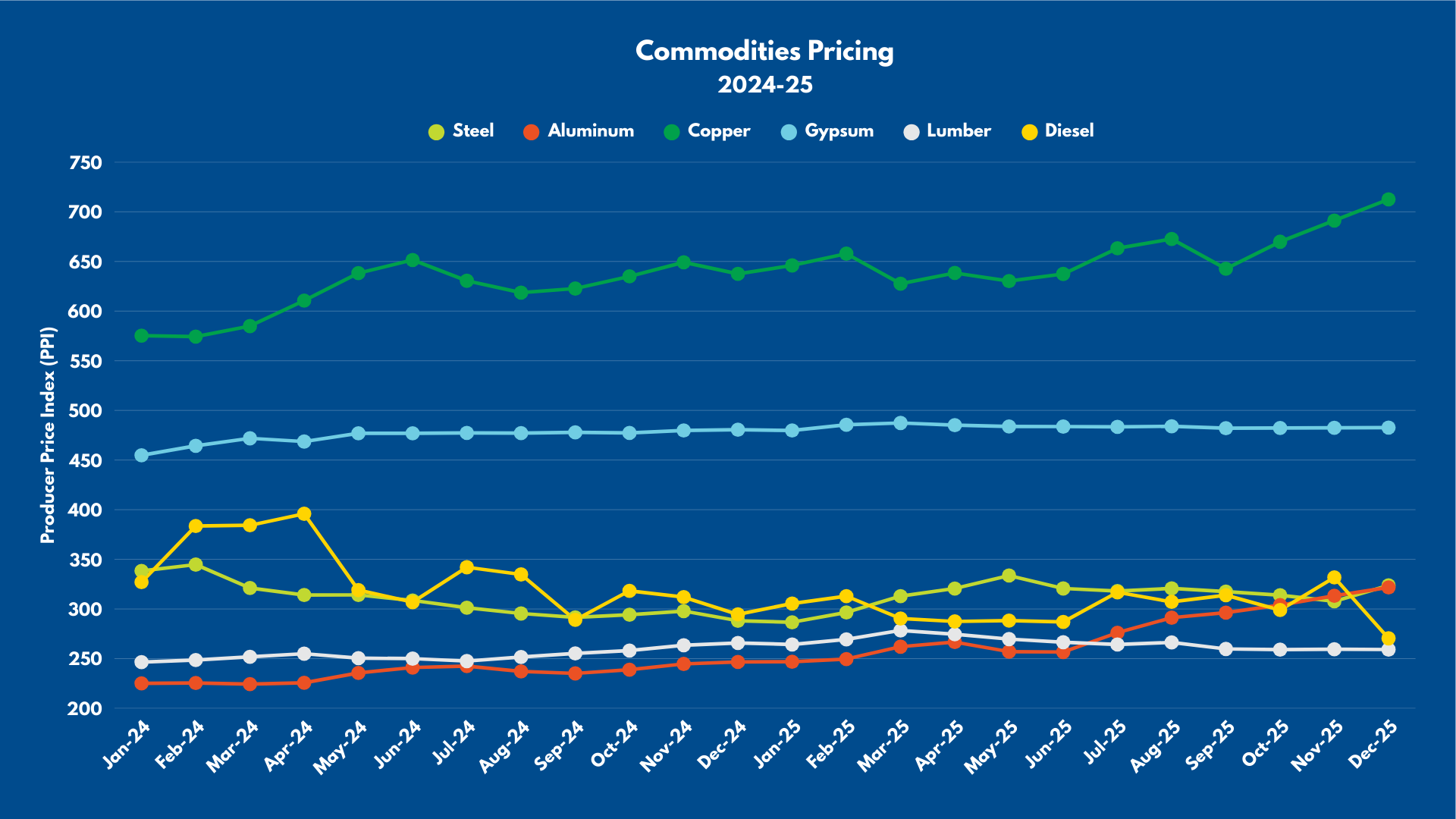

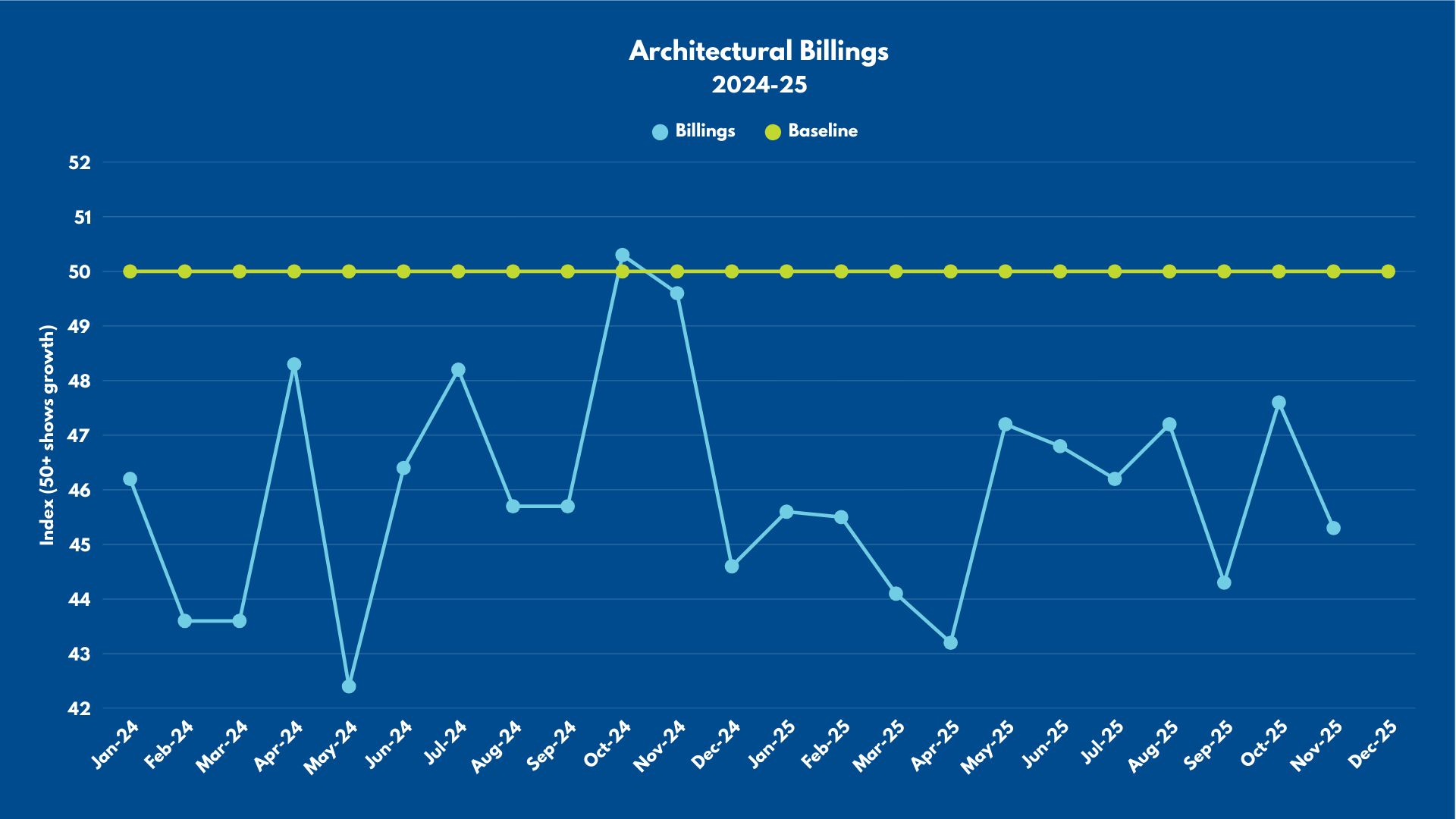

Within the construction sector, cost pressures ran slightly above historical norms. Material escalation, particularly in steel, copper, and aluminum, accounted for most of the increase, and a growing share of trades reported rising labor and input costs compared to the prior quarter. Backlogs generally remained stable, while competitive bidding intensified across more segments of the market.

Looking ahead, the combined direction of fiscal and monetary policy suggests continued economic expansion and a supportive environment for construction demand. Workforce availability is expected to remain constrained throughout the year, and select materials — most notably mechanical and electrical equipment — are likely to remain challenging due to extended lead times and upward price pressure.

Construction

Indicators

Cost pressures ran slightly above historical norms with material escalation accounting for most of the increase.

Overall, while pockets of the market remain challenged, the combination of easing financial conditions, structural demographic strengths, technological adoption, and a stabilizing cost environment position 2026 as a pivotal year. If current trends hold, the industry appears poised to transition from a defensive posture toward a new cycle of thoughtful, strategically aligned growth.

Is 2026 the Year Commercial Real Estate Turns the Corner?

In this spotlight, Real Estate Investment Director for JE Dunn Capital Partners Chris Hermreck examines the ongoing transformation of the commercial real estate market. It discusses how demographic shifts, technology advancements, and regulatory changes are influencing investment strategies, operational performance, and the long-term competitiveness of real estate assets.

Insights

Mitigating Labor Risk Can Make a Project More Viable in New Ways

With the ongoing labor shortage, lenders are increasingly factoring workforce stability into their risk assessments and are requiring higher equity and larger contingency for firms without stable labor pipelines.

Insights

Sustainability as a Financing Criteria

Sustainability-linked loans have gone mainstream and are transforming into a powerful financing lever in the current debt market.

Insights

Financing the Infrastructure that Makes AI Possible

As data center construction continues to grow, these megaprojects are changing how investors strategize, shifting from passive to active involvement while lenders are increasingly paying attention to specialty trades and backlogs when it comes to assessing risk.

Local Market Overviews

Stay informed with what is happening in your local market. Download your localized report now!